Case Study: An Integrated Asset Investment Planning and Management Process at National Gas Transmission

`In preparation for RIIO-2, the regulatory framework for energy networks in the UK, National Gas Transmission (NGT) partnered with Copperleaf® to improve its Asset Investment Planning (AIP) and Project Portfolio Management (PPM) capabilities. This paved the way to a streamlined approach to formulating asset investment plans for regulatory submissions.

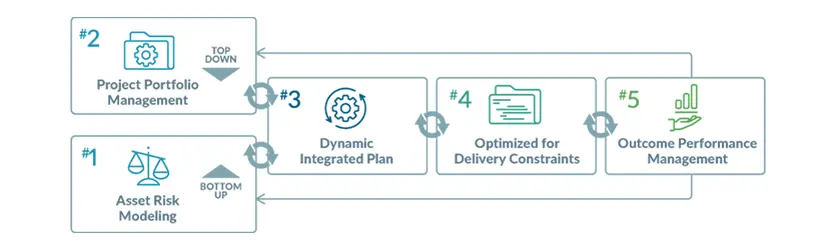

Many organizations still rely on a modeled view of asset risk and intervention strategies, which can lead to a disconnect between the plan and the projects that are actually delivered. Copperleaf helped NGT integrate bottom-up asset strategies with top-down project portfolios and align with ISO 55000 best practices. This will unlock significant benefits in the RIIO-T2 regulatory period and position NGT to develop the RIIO-T3 plan.

Asset Investment Planning & Management at NGT: An Integrated End-to-End Process

Implementing an End-to-End Solution

NGT needed its new system to support an integrated view of asset data and provide a clear line of sight between investment management, portfolio planning, and investment governance. The implementation involved large-scale data integrations, specialized reporting, and accommodating approximately 250 asset risk measures, including over 100 monetized risk measures. Copperleaf also worked with NGT to configure Network Asset Risk Measures (NARMs) risk models within the Copperleaf Value Framework.

Using an Agile implementation approach—as opposed to the more traditional Waterfall methodology—meant that functionality could be released much earlier. This agile approach was the first of its kind undertaken by Copperleaf’s Customer Experience team and was extremely successful. Giving stakeholders the opportunity to see the system in action while work on the configuration was still underway helped build confidence in the final deliverables.

Reaping the Rewards

The Copperleaf Decision Analytics Solution, which includes Copperleaf Portfolio™ and Copperleaf Asset™, will contribute to a 4% reduction in NGT’s capital expenditure, saving £11 million per year—a significant return on investment. These benefits are derived from the new capability to make value-based decisions on the future of the network—across the entire asset lifecycle and centered around the organization’s key strategic objectives.

The biggest benefit is that we now have an end-to-end solution. We can start off with a rough idea of the projects we need to undertake to achieve our strategy and then track that investment all the way through to delivery and benefits realization.Asset Modelling Manager

National Gas Transmission

Read the full case study on NGT’s asset management journey here to learn more about the benefits, including:

- Improved asset risk management

- Employee productivity improvements

- Enhanced portfolio planning

- System rationalization

- Improved agility